The goal is the market structure bill before the end of September – Genius Act is 3% in their profit, as stated during the session by Senator Lummis, White House advisor Beau Hines, and Senate Banking Committee Chairman Tim Scott.

Joining WEEX now gets you a 20% bonus and instant VIP2 — no extra steps needed. Claim your rewards!

If you’re going to trade anyway, why not get rewarded like this?

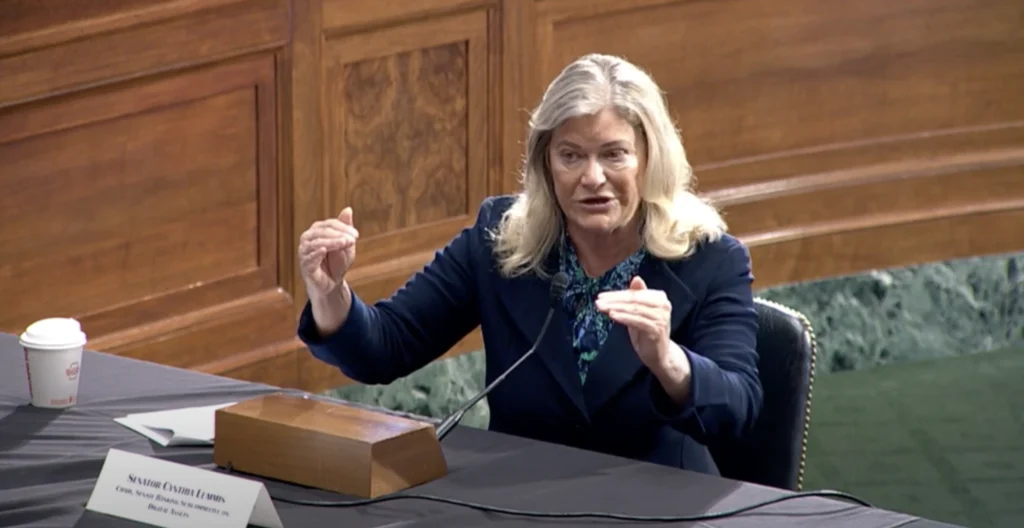

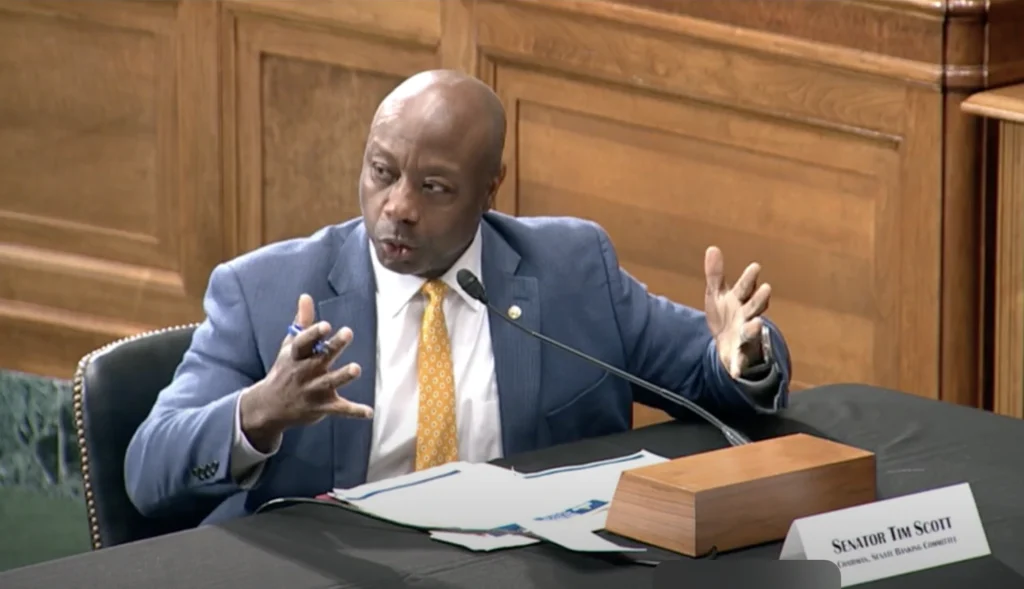

Remarks by Lummis, Hines, and Scott

The United States has confirmed concrete steps toward digital regulation reform with the involvement of Senate Banking Committee Chair Tim Scott, Senator Cynthia Lummis, and White House Director for Digital Policy Bo Hines. At the center of the discussion is, of course, the GENIUS Act, aimed at establishing a regulatory framework for stablecoins backed by the U.S. dollar.

Bo Hines stated:

“Revolutionizes the financial system, adding that its adoption would pave the way for the full launch of tokenized government securities and modernization of the payments infrastructure.”

Naturally, Senator Lummis emphasized the importance of digital assets as a new form of strategic reserves and a tool for expanding investment portfolios. She also cited the example of one of the largest stablecoin issuers, which is already among the top 20 holders of U.S. Treasury securities:

“We will see more stable coin businesses come into that top 20.”

In turn, Tim Scott underlined the strategic significance of the GENIUS Act for the financial industry and its direct relevance to the country’s economic sovereignty:

“You’re talking about something that basically secures US dollar global dominance for decades to come.”

He also noted the act’s immediate importance for market participants:

“Genius Act is 3% in their profit, overnight.”

The GENIUS Act is expected to be merged with parallel initiatives from the House of Representatives, including the Stables Act, into a unified version that aligns closely with existing banking standards.

This is leading to a broader reassessment of market structure, which was actively discussed during the session. Most notably, timelines were addressed, with Tim Scott declaring:

“I want to set a timeline… of seeing the market structure completed before the end of September.”

Senator Lummis confirmed this intention:

“We will make sure that we’re ready to do that. We want to provide clarity within the regulatory framework. Quickly, clearly, and without threat of protracted litigation.”

They also reflected on the successful experience of advancing FIT 21 legislation through the House and the challenges of progressing the GENIUS Act within the Senate. They stressed that the new regulatory framework must strike a balance between consumer protection and avoiding “overregulation.”

Thus, the bill is expected to become the second pillar of a “dual architecture” and will cover principles such as asset classification (securities vs. commodities), jurisdictional delineation between the SEC and CFTC, and defining rules for “ancillary assets”–those that lie between traditional categories.

In his concluding remarks, Bo Hines emphasized that the White House sees these efforts as a foundation for restoring innovation leadership in the US:

“We are well on our way to achieving that thanks to your hard work. America is open for business, and we will be the cryptocurrency capital of the world.”

He also drew a connection to the Trump administration, whose stance he described as highly specific:

“He understands the urgency of having the United States create a beachhead for this industry. We need a regulatory framework that is clear, and we need it yesterday.”

Joining WEEX now gets you a 20% bonus and instant VIP2 — no extra steps needed. Claim your rewards!

If you’re going to trade anyway, why not get rewarded like this?

Conclusion

Roughly a year ago, the initial US efforts toward cryptocurrency policy seemed intense in isolation. However, they now appear to be just the beginning. We are witnessing coordinated initiatives and forward-looking planning from the SEC Crypto Task Force, the Bitcoin reserve and even the crypto stockpile, and the GENIUS Act – and this likely isn’t the end.

Even more striking is the synchronized momentum in other key jurisdictions such as Canada, the UK, and the EU. Stay tuned for further updates about developments in crypto, blockchain, and digital asset regulation.