MUFG tokenizes Osaka office for $681M via Progmat – Mitsui changes trust provider but remains in the Progmat ecosystem. At the same time, tokenized assets are gaining momentum beyond Japan, and the global trend points to $2T in market capitalization by 2030.

On the institutional level, the assets will be structured as a private REIT, with insurance companies as the primary participants. For retail investors, MUFG plans to issue fractional tokens providing access to commercial real estate without the need for multi-million-dollar capital.

The tokenization architecture is implemented through the Progmat platform – a digital infrastructure that MUFG spun off into a separate legal entity. Despite the formal separation, MUFG retains a 42% ownership stake in Progmat and continues to provide backend operational support.

And all of this takes place against one important fact: Mitsui Digital Asset Management has ended its use of MUFG Trust as legal custodian for security token issuance. Instead, the company has deployed its own infrastructure, Alterna Trust, designed to accelerate the launch of new tokens. And this is an active infrastructure: as of today, Mitsui has conducted 16 real estate token offerings, 14 of which were through its own retail-facing Alterna platform.

But Mitsui has not exited the Progmat ecosystem. Despite terminating its relationship with MUFG Trust, the company signed a separate agreement to continue working with Progmat, and plans to launch most of its upcoming tokens on the platform. What does this mean? It means that Mitsui and MUFG are now direct competitors at the trust structure level, while still connected through a shared infrastructure layer.

If you’re gearing up for higher-volume trades, a $2,000 deposit gets you the max $300 BloFin bonus — more cushion, less friction.

Global Trend in Tokenized Assets – Trillions Ahead?

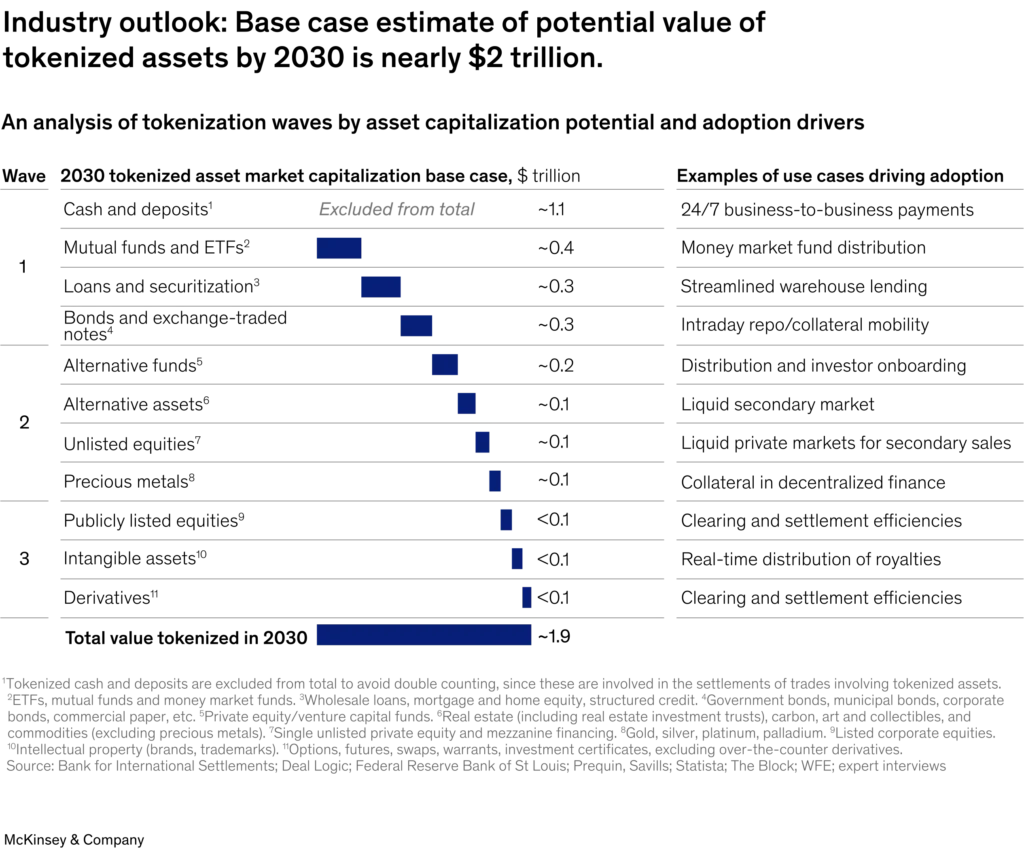

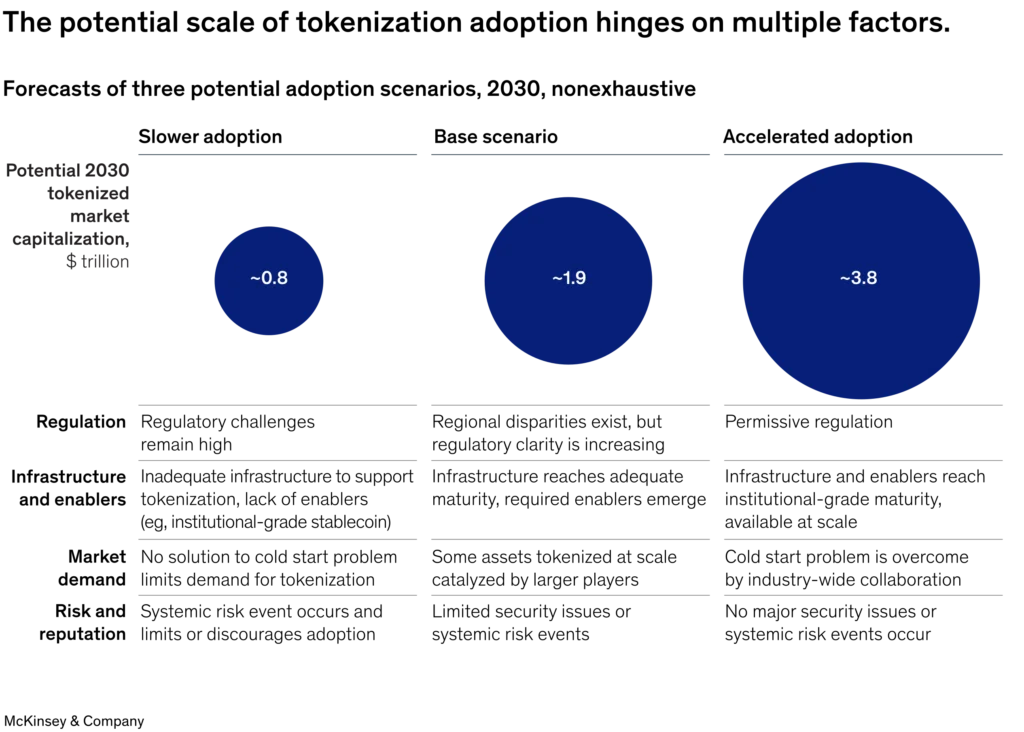

According to McKinsey, by 2030, the capitalization of tokenized assets may reach $2T. Moreover, this is the mid-range estimate, with the lower bound at $1T and the upper bound at $4T. This means that even the most conservative level far exceeds the combined scale of all documented pilot launches from 2017 to 2023. In percentage terms, the comparative growth rate suggests that tokenized assets will show a compound annual increase above 50%, and over 75% in certain segments.

All of this may be potential, but it sends strategic signals. McKinsey says that around $0.4T may be attributed to mutual funds and ETFs, with the same amount collectively in lending, bonds, and exchange-traded notes. The repo segment is assessed separately, with existing transaction volumes in the trillions of dollars per month, already demonstrating actual adoption of on-chain architecture without waiting for a full transformation of the surrounding infrastructure. Its potential in the 2030 capitalization estimate stands at $0.6T – the largest among all classified categories.

Lower-capitalization but tech-driven assets, such as alternative funds, private equity, commodity-based, and derivative tokens, will collectively contribute under $0.5 trillion, but may act as accelerators of integration due to their low friction and flexible ownership logic.

If you’re gearing up for higher-volume trades, a $2,000 deposit gets you the max $300 BloFin bonus — more cushion, less friction.

Conclusion

The point here is not abstract volume, or even the precision of the numbers – it’s the pace of consolidation. As of 2023, the total tokenized securities market remained in the $10–20 billion range, but by mid-decade, it may exceed $500B, and by the end – $1T and beyond.

This is equivalent to the total size of all real estate funds under management in Europe or the combined volume of investment-grade debt across ASEAN. This may indicate that tokenization has already moved beyond proof-of-concept and is entering a phase of industrialization. Stay tuned for the latest updates in crypto, blockchain, and DeFi.