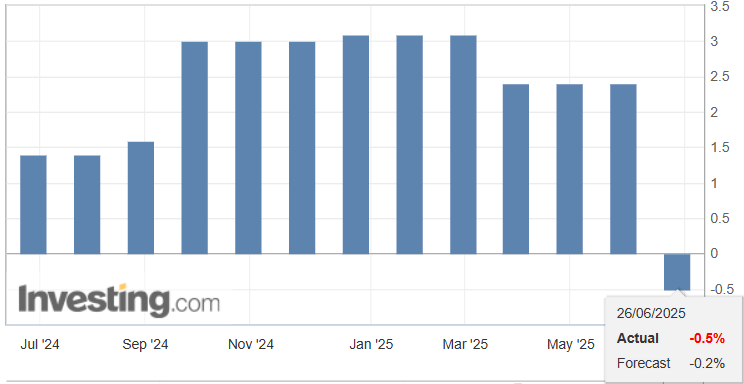

The final revision of America’s GDP in the first quarter just came in, and it’s not that good. Moving into it, the second revision showed a 0.2% contraction in the American economy from January until March.

However, the Bureau of Economic Analysis released the third and final revision for the Q1 GDP. The data revealed an even grimmer recession indicator, showing a -0.5% contraction in the economy during the first quarter.

This decrease in economic power can be attributed to three primary factors:

Government Spending Cuts

Under the leadership of Elon Musk at the Department of Government Efficiency (DOGE), federal spending decreased by 5.1% in the first quarter. These cuts included massive layoffs of federal employees, reductions in several government contracts, as well as some more controversial decisions, such as slashing pediatric cancer research.

In truth, such aggressive cuts were expected to affect the American economy. As the number of government contracts, jobs, and projects exists, it creates a weaker demand that ultimately means less money circulating in the economy.

Weaker Consumer Demand

Consumer spending slowed to 1.8%, down from 4.2% in Q4 2024. While we saw a surge in consumer spending during the first two months of the year, Americans cut down on spending after Trump’s tariffs were announced.

Even with the significant surge in big-ticket purchases like vehicles, consumers and businesses had a narrow window to act. So while there was a brief surge in spending and importing, it was later overshadowed by a pullback in consumer spending.

Surge in Imports

Also affected by the tariffs, Americans rushed in to buy imported goods in the first quarter to beat the looming April 2 tariff deadline. This led to a sharp, front-loaded spike in imports, particularly in electronics, machinery, and consumer goods, as businesses and households scrambled to stock up before prices rose.

The Gross Domestic Product, as its name suggests, only accounts for domestic production. So when imports surge, regardless of the reason, it actually becomes a burden on economic growth by GDP metrics.

Bitcoin Reacts to GDP

Seen as a potential recession indicator, especially when compared to the 2.4% growth seen in the last quarter of 2024, Bitcoin erased about four hundred bucks of its price per coin as soon as the GDP Q1 report came out.

Currently, the market-leading cryptocurrency trades at $107,140 – a tad behind the $108,184 value it had this morning. Overall, Bitcoin is seeing a 0.78% deficit over the last 24 hours.

A slight retraction was expected, as GDP contractions may ignite fears of stagflation in the economy. But the bigger question now shifts to interest rates.

A sharper-than-expected GDP contraction pressures the Fed into rethinking its policy, and potentially increases the chance of an interest slash later down the year. With economic growth noticeably slowing down, the Federal Reserve may need to ease policy to avoid a year-long recession.

The first GDP reading of Q2 comes out on June 30, and if it reinforces the notion of a GDP retraction, it could cement expectations for a rate cut as early as the Fed’s September meeting.

PS: If you’re actively trading, BloFin’s WOW2025 is live — with $4.2 million and a Tesla Cybertruck up for grabs. Register here.