Table of Contents

Heading up to this Thursday, the crypto market appeared to be heading towards another rally. The total market capitalization of all cryptocurrencies hit its highest point since May 27 at $3.44 trillion, leading investors to believe this could be the start of a major bull run.

However, things didn’t go as smoothly on June 12. Digital assets saw a sharp plunge in their market value, as total market capitalization dropped by 3.04% during the day, erasing over $100 billion from the market.

Despite positive signs from the Bureau of Labor Statistics that American inflation is rising at a lower rate than anticipated, nearly all crypto assets lost value on Thursday, but why is that? Let’s cover why crypto is down today.

Bitcoin $110K Breakout Fails

Yesterday, $BTC hit its highest point in the week. At first glance, it looked like the world’s highest-valued digital asset would make a climb toward new highs. However, bulls failed to drive bitcoin into a breakout above the $110k resistance, prompting a plunge back into the $106K support:

This selloff caught many traders by surprise. The failed breakout led to massive liquidations, wiping out over $323 million in leveraged positions from the market. In total, 132,569 traders saw their positions liquidated, bringing the total value of liquidations to $665 million, according to CoinGlass.

Technical Analysis of Bitcoin’s DIP

While Bitcoin was ranging at the daily chart, the RSI indicator showed signs of bearish divergence at the start of the month—indicating that buy strength was fading.

MACD corroborates this narrative as its histogram traded bearish for nearly the entirety of June.

According to this data, Bitcoin has been showing signs of weakened buying pressure throughout June—even despite the bullish momentum seen at the start of this weeak. While these indicators point to potential bearish tendencies, market conditions can shift depending on external factors like macroeconomic trends, so let’s have a look at those.

Inflation is Not ‘Really’ Declining

Despite this week’s CPI and PPI data showing that inflation is rising lower than expected, American consumers are still feeling the impact of inflationary pressures. Moreover, prices in basic necessities products and services like utility gas and electricity are rising, as detailed by this post by the Kobeissi Letter.

While May CPI inflation was 2.4%, inflation is much higher in many basic necessities:

— The Kobeissi Letter (@KobeissiLetter) June 11, 2025

1. Utility Gas Inflation: +15.3%

2. Car Insurance Inflation: +7.0%

3. Meat and Eggs Inflation: +6.1%

4. Car Repair Inflation: +5.1%

5. Electricity Inflation: +4.5%

6. Homeowner Inflation: +4.2%…

For investors, this means that inflation concerns remain despite softer headline data. Inflationary risks may not be fully priced into markets, and a decent gauge for this is the fact that bond markets are reacting cautiously. Yields on Treasury bonds, particularly long-term securities, have remained elevated despite softer CPI and PPI prints.

Just this week, the 30-year U.S. Treasury bond auction saw yields come in at 4.844%, slightly above the previous auction’s 4.819%. This suggests that investors demand higher returns, possibly reflecting concerns about inflation and higher borrowing costs.

Interest Rate Cuts Are Unlikely

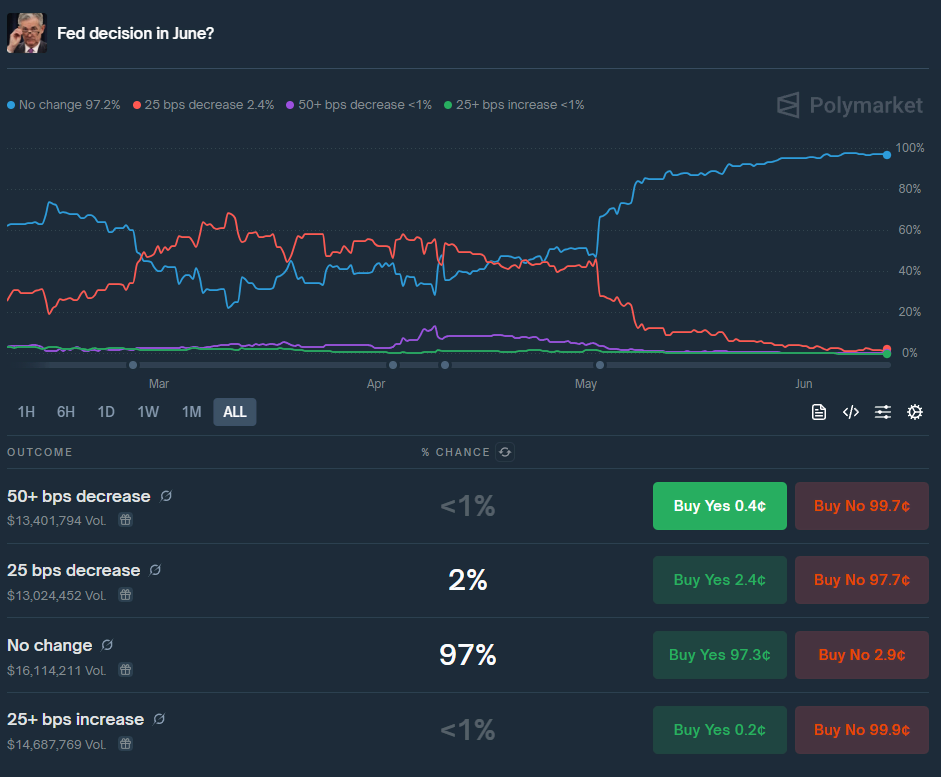

Less than a week before the next FOMC meeting on June 17–18, the investment community is not holding high hopes that the Fed will agree on a rate cut yet. In fact, 97% of investors in the prediction platform “Polymarket” believe rates will remain unchanged after this month’s meeting.

Iran Conflict Raises Uncertainty

Geopolitical uncertainty has also played a role in market sentiment this week. Today, President Trump ordered U.S. military families and non-essential personnel to evacuate the Middle Eastern region due to rising tensions with Iran.

This move follows failed attempts by this administration to come to terms with the Iranian government regarding nuclear agreements. Also, early reports indicate that Israel could be preparing an attack on Iranian territory.

While financial and investment markets’ volatility is far from the main issues with war, geopolitical instability often spills over into economic uncertainty. In times like these, investors typically move their funds to safe-haven assets like gold. For Bitcoin, the asset has been proving its worth as a hedge in recent months, and many investors are watching closely to see whether this trend continues.

Limited-Time Promo: Get 10% Off the Legends Community Plan

🚨If you’ve been thinking about joining the Legends Community, now’s the time! First-time users can get 10% off the 3-month plan with code BTCSPROMO10 — but hurry, it’s only valid until Friday the 13th at 23:59 CET.

👉Head over to the community page, choose the 3-month option, and enter BTCSPROMO10 at checkout.